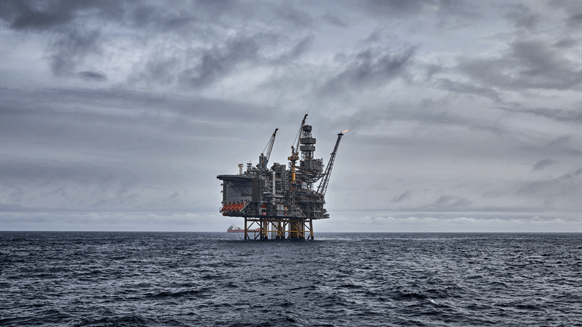

Petrofac said it has secured a two-year, $50 million contract renewal from Ithaca Energy, extending its work for the oil and gas company in the North Sea.

Under the integrated services contract, Petrofac will continue to provide operations, maintenance, engineering, construction, and onshore and offshore technical expertise, the company said in a news release.

The scope extends across Ithaca Energy’s North Sea operated asset base, which includes Alba, Captain, Erskine and FPF-1, according to the release.

John Pearson, chief operating officer of Petrofac’s asset solutions and energy transition projects said, “The continuation of our longstanding relationship with Ithaca Energy is testament to the safe and reliable delivery of operations services by our team, who have been embedded on these assets for well over a decade. The North Sea is one of Asset Solutions’ core markets and this award underlines the commitment from both Petrofac and Ithaca Energy to the region. We remain focused on supporting Ithaca Energy to maximise safe, efficient and responsible production from its assets”.

Also in the North Sea, Petrofac secured a contract extension from Shell UK-operated venture ONEgas West.

Under the contract, Petrofac will provide services across ONEgas West’s Southern North Sea portfolio, supporting the Clipper South complex, Leman Alpha assets, Bacton Terminal, and OneGas Barge campaigns.

Financial terms of the contract extension were not disclosed.

Pearson said, “Having supported these assets since 2020, Petrofac is embedded within the delivery team and is uniquely placed to support production enhancement and field life extension. The North Sea remains one of Asset Solutions’ core markets and this award demonstrates confidence held in our team and the value they drive. We look forward to continuing this relationship, delivering safe and reliable operations”.

Agreement Reached on Restructuring

Meanwhile, Petrofac said it has reached an agreement in principle with Samsung E&A Ltd. and Saipem SpA regarding their claims relating to the Thai Oil project.

On July 1, the United Kingdom Court of Appeal set aside the High Court of Justice’s sanction for Petrofac’s restructuring plan in favor of Saipem and Samsung. The parties had been part of the failed Clean Fuels Project that aimed to enable the production of cleaner fuels at a Thai refinery.

Saipem and Samsung had claimed that the Thai project would be compromised under Petrofac’s restructuring plan.

Petrofac said the new commercial terms are supported by the Ad Hoc Group of Bondholders, subject to the agreement of longform documents. The agreement will enable its restructuring to proceed with the consent of those parties, according to a separate statement.

The company said it expects restructuring to be completed by the end of November.

Petrofac in August said that it had secured an extension of the original lock-up agreement, which outlines the terms of its comprehensive financial restructuring plan. The bondholders, investors and creditors party to the agreement have reinforced their support by committing to an extension until Nov. 30, the company said.

Petrofac Group Chief Executive Tareq Kawash said in an earlier statement, “The agreement of stakeholders to extend the Lock-Up demonstrates their support for the work underway to address the narrow grounds on which the Court of Appeal upheld the challenge to our Restructuring Plan. While the need for the balance sheet restructuring remains clear, the commitments formalised today give me confidence that we can deliver a successful outcome”.

“Petrofac’s operational capability remains intact, and the business continues to deliver for its clients. We have secured new contract awards and have a strong pipeline of future opportunities. This is in no small part thanks to the dedication of our people, and the continued support of our clients and suppliers. Following a prolonged period of challenge for the Group, I am more focused than ever on delivering the best possible outcome for all stakeholders,” Kawash added.

Source: By Rocky Teodoro from Rigzone.com